- New Joiners: If you have any new joiners, you can add them into the system from the New Joiners section (see https://support.huskyfinance.com/husky-payroll/how-to-add-new-joiners

-

Provide changes: Once you log into Husky, you will see the current payrun in the Portal where you can enter this month’s changes. You have two options:

-

Enter the changes from the UI: you can add annual salary changes and leavers (add separate section below)

-

Upload the changes: You can upload a document or spreadsheet with any changes (hours worked, commissions, sick pay, etc.) under the “Inbox” section.

Once done, click on “Submit payroll changes” and our team will received a notification to get the payroll started.

-

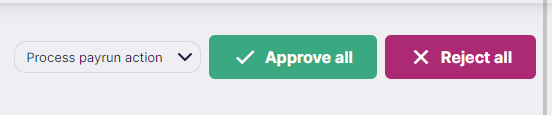

Draft approval: Once your payroll is ready, the payroll team will send you an email so that you can review your payroll. You can click on each employee to see their pay details and deductions and on the “Reports” tab you can find the payroll summary report and the draft payslips. If everything is correct, you can click on “Approve all”.

-

Finalise: Once approved, we will finalise your payroll (you will receive a notification once the final reports are ready).

-

As an employer you are responsible for paying your employees (you can see the NET pay due in the Final reports)

-

Payslips will be scheduled to be available in the Husky app on pay date and employees will also receive an email notification

-

HMRC submission will be done on pay date on your behalf – you can see the amount due to be paid to HMRC on the third tab of the Final Summary Report