You can either follow the steps below with our screenshots and descriptions or watch our video guide here: https://www.youtube.com/watch?v=dFx8nI5VGWo

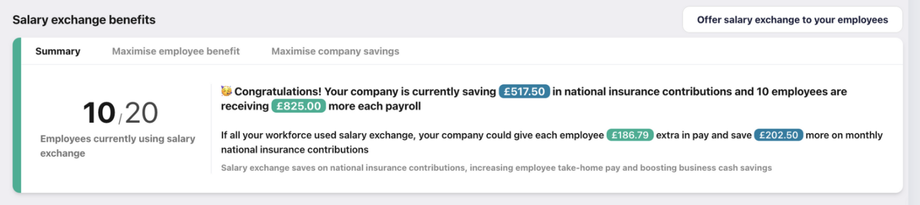

When you log in to Husky, you'll see the Salary Exchange component on your dashboard, even if Salary Exchange isn't implemented.

In this example, you can see that this company has 20 employees, but only 10 have started using Salary Exchange. They're saving a lot each year. It's a win for everyone! Don't worry, here you will see exactly how much your company and employees can save with Salary Exchange.

To begin setting up and communicating with your employees, simply click on 'Offer salary exchange to your employees'.

You can watch our explanatory video and learn more about what it is and how it works.

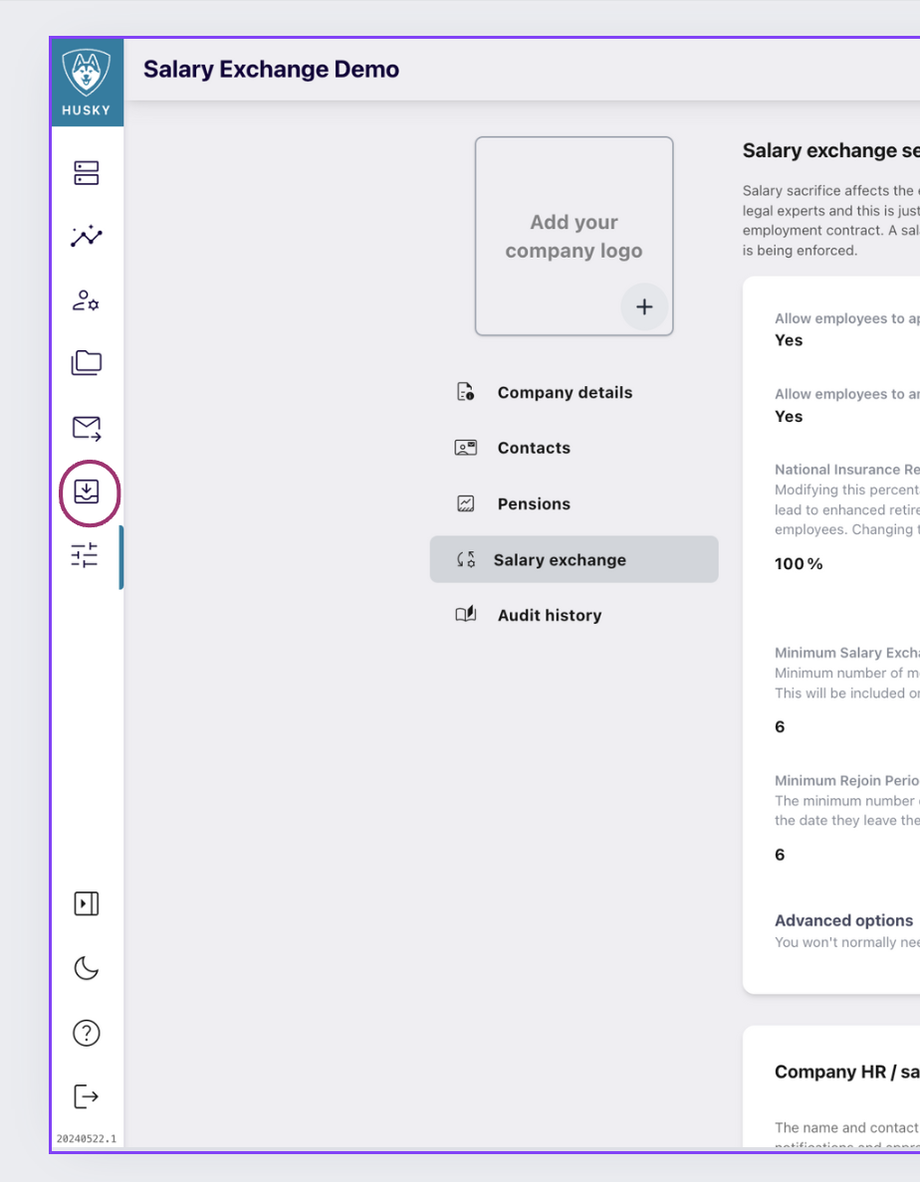

Click on 'Configure salary exchange' to begin configuration and get your employees started.

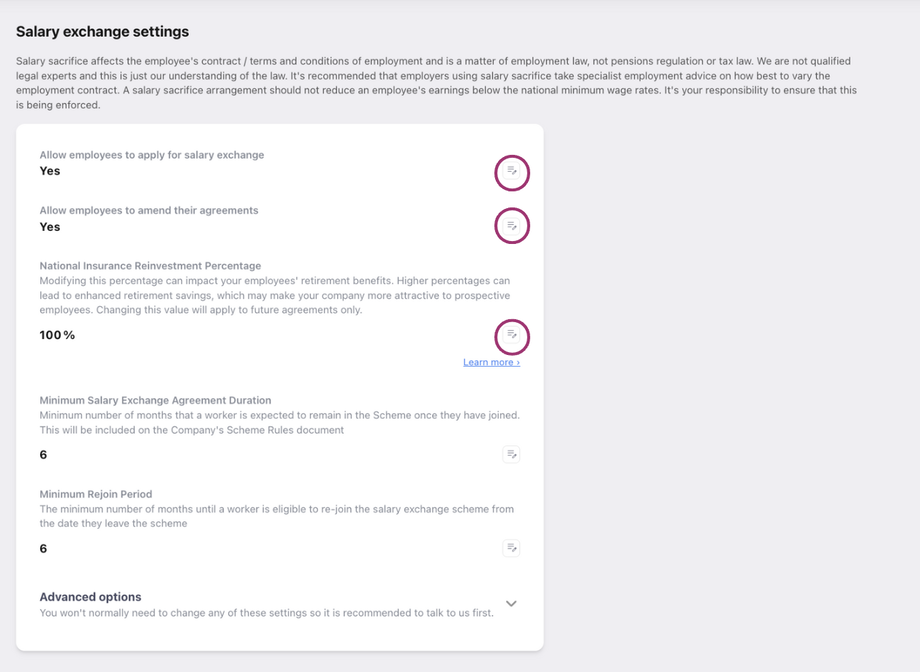

Set these fields to "Yes" , employees will be able to apply directly through the app, and to allow employees to also update the % of pension they are contributing during the year.

As the employee’s gross earnings are reduced, the employer also saves on their National Insurance Contributions (NIC). Those savings can be kept by the employer or re- invested into the employees' pension. Choose here the % of savings you want to re- invest into your workers' pension (100% being all savings go to pension.)

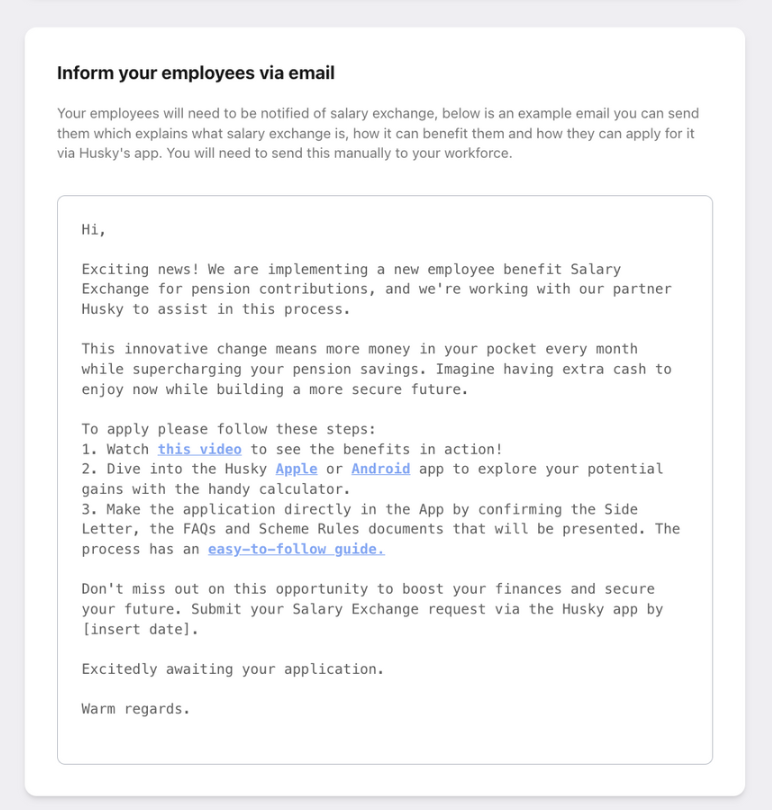

We've prepared this email template for you, so you can simply click here to copy it and communicate with your employees.

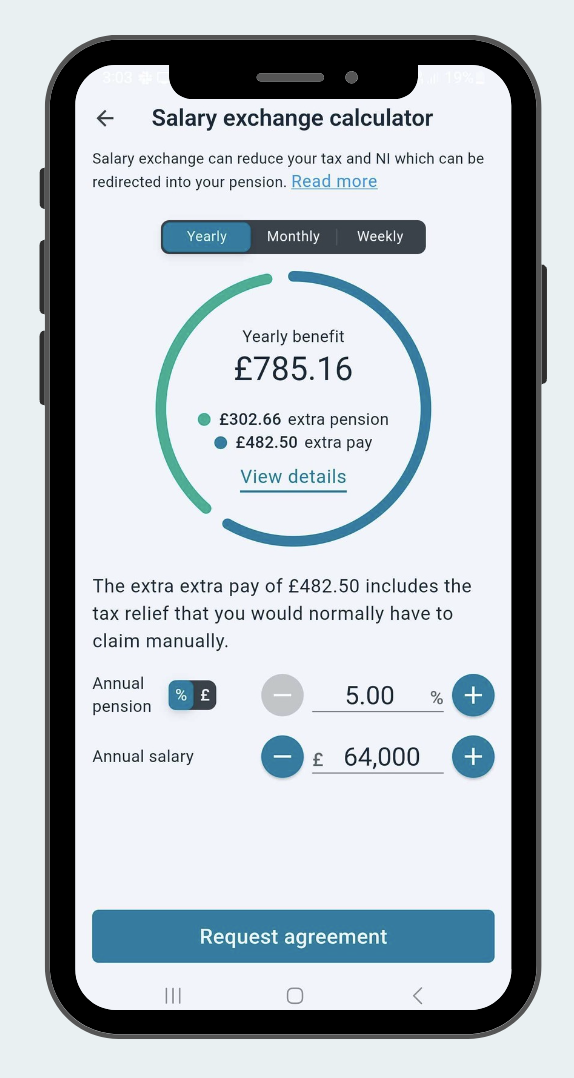

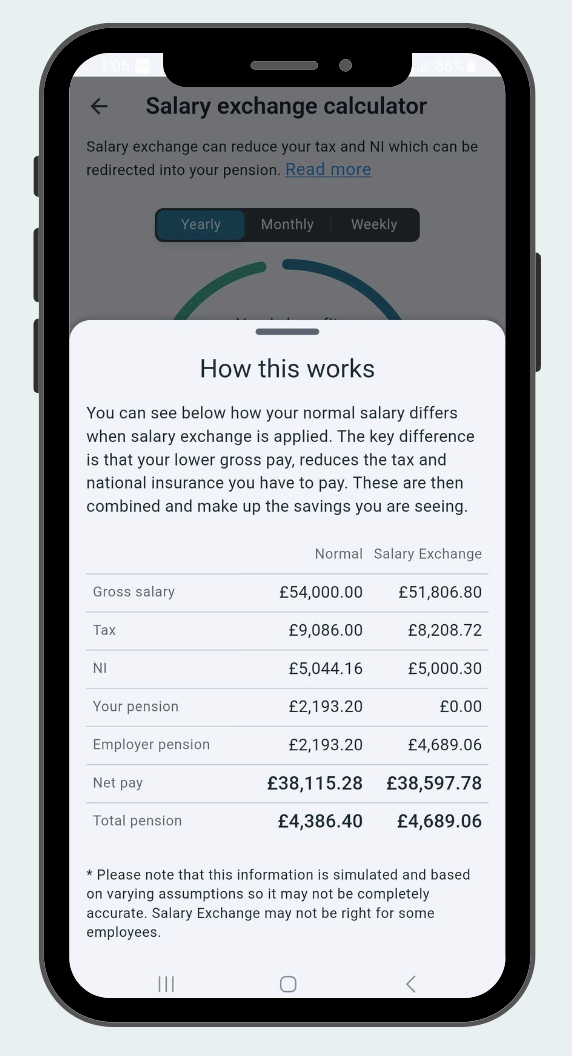

Workers will download the app, login, link their pension scheme in the app via the code sent in the invitation email and apply for Salary Exchange. The worker can see on the dashboard, the boost to their pension, and the extra take-home pay.

The amount or % can be amended but always has to be above the minimums (basically 5% is not always the minimum). This requirement is set by the Government for any workplace pension. If you want to learn more you read our article.

As you can see with Salary Exchange, your staff can adjust their take-home pay, incurring less NI, leaving more money in their hands, month after month. Your company will also pay lower NICs and Corporation tax. It’s a win-win for both employers and staff.

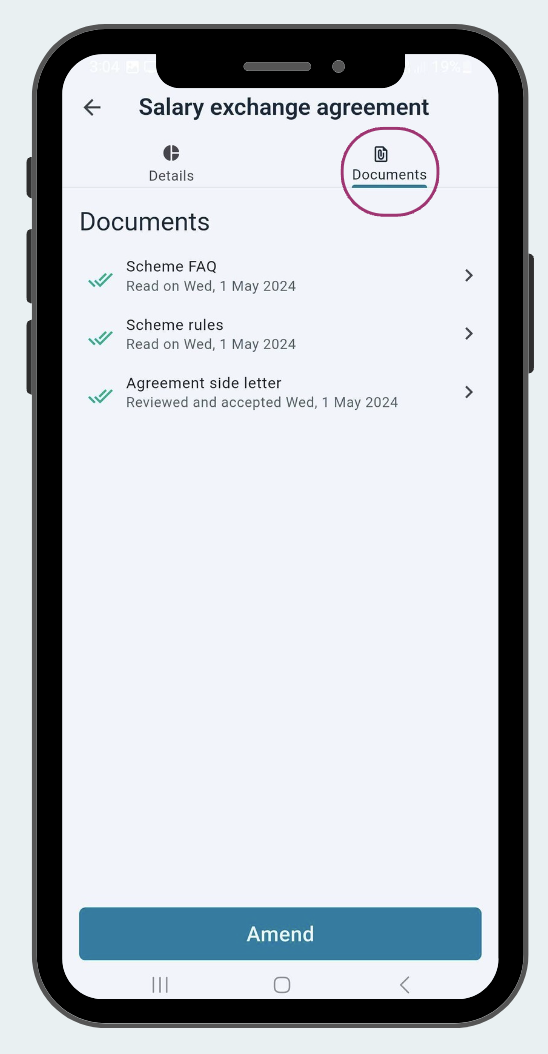

Your employees must sign the documents within the app.

Each time an employee makes the request, Husky will send you a notification via email, so you can simply click here to go to approve the requests.

As an employer, you must approve the request through the employer dashboard. This action adds the employer's signature to the agreement. Remember to approve any request as soon as possible so it doesn't expire. *Take into account that employees cannot fall below the minimum wage after Salary Exchange.

As you can see, the entire process is simple and automated. Let's see what happens next.

When Salary Exchange starts?

Salary Exchange starts on the first day of the next payroll period, not immediately. For instance, if a worker requests it between 01/05/2024 and 31/05/2024, and the employer approves, it will begin on 01/06/2024.

How are Payroll going to know?

The payroll users will receive a monthly report with any new salary exchange deductions.

Now, proceed to your dashboard and initiate the process of saving your company and workers a significant amount of money.